Introduction

2022 was a challenging year, marked by the Ukrainian war, rising inflation and energy crisis. Soaring interest rates triggered a crypto winter in 2022, producing a wave of high profile bankruptcies sending the prices of many popular cryptocurrencies tumbling. This widespread debacle generated deep public distrust in the crypto industry.

A Regenerative Finance (ReFi) movement emerged against this backdrop as a new Web3-powered movement which lies at the intersection of crypto and impact. And 2023 is widely expected to be the year the sector goes mainstream. Currently, over a quarter of all venture capital funding is going to climate technology. Global tech layoffs, the search for purpose, and high-growth environments, are compelling the brightest minds towards climate tech and Web3. Just as venture capitalists have embraced ESG targets and sustainability-focused funds, this year impact and crypto funds are turning to ReFi-themed projects for investment opportunities.

The term Web3 covers a number of trends that converge in the “decentralised internet” which is set to supersede current centralised Web2 controlled by corporations like Facebook and Google. Web3 technologies like blockchain, cryptocurrencies, NFTs and DAOs provide the tools to implement digital democracies and novel ways of collaboration. This collaborative nature of ReFi stands in stark contrast to the competitive nature of Web2.

From Sustainability to Regeneration

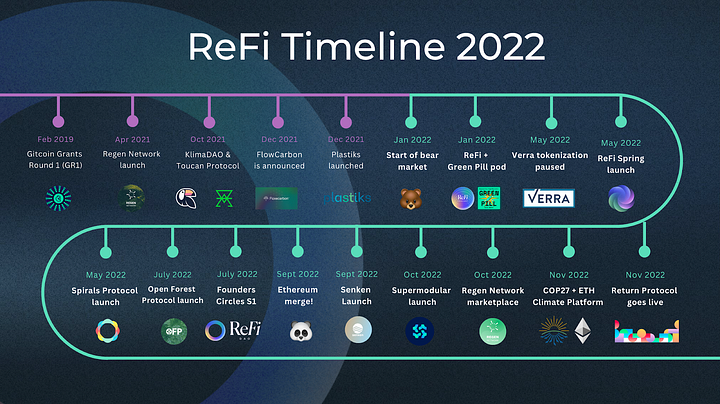

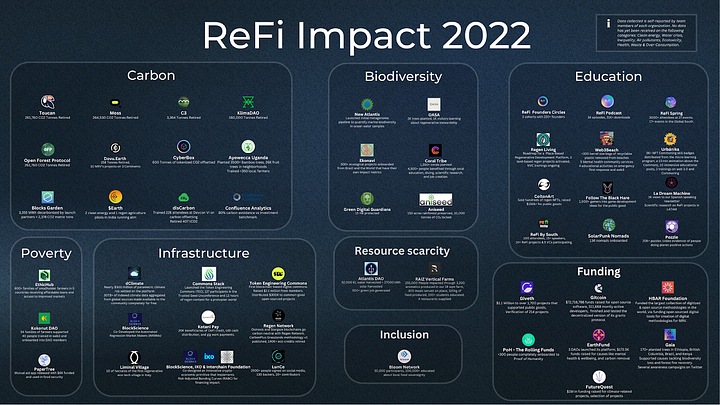

Over the last year, ReFi has grown from a niche area of Web3 bringing carbon credits on-chain to a thriving ecosystem of projects extending regenerative values to an ever diverse set of sectors. Indeed, there have been challenges along the way but a vibrant community is emerging and shaping into a robust environmental, social and economic movement. Web3 technology helps mission-driven communities to manifest shared values, define planet-positive objectives and coordinate large amounts of capital and resources to create public goods.

In parallel, a shift from sustainable to regenerative goals is taking place within the impact space. The essence of sustainability is to do less harm in order to reach net zero global outcomes. By contrast, regeneration seeks to help living systems thrive to produce net positive outcomes for the planet and humanity as a whole. ReFi leverages crypto to solve real world problems crystallised on the SDGs creating a shared objective with TradFi impact investors. ReFi is reimagining the financial system to drive positive externalities and regeneration as opposed to degeneration and extractivism.

ReFi can be viewed as a counter to “Degen” culture. The Degens care about making money on crypto, the “Regens” care about doing good by stripping Web3 of its price speculation while focusing on impact.

What is Refi?

ReFi is anchored in decentralised finance (DeFi) and John Fullerton´s theory of regenerative economics. DeFi refers to an alternative financial system focused on the democratisation of financial goods and services. Regenerative economics focuses on the creation of systems that restore and preserve the physical resources essential for planetary well-being. Our current economic paradigm fails to value the role these resources play in our collective well-being, resulting in negative externalities including GHG emissions, biodiversity loss and social inequality.

The underlying ethos of ReFi is “collaboration over competition.” Climate change is in essence a global coordination failure so tribalism needs to be replaced with new models which result in positive environmental and social outcomes for all, not just the privileged few. ReFi addresses both the failure of traditional markets to account for the negative externalities and current global inefficient allocation of resources.

Overall, the unique value of Web3 for climate action can be summarised as follows:

- Monitoring and traceability of GHG emissions along global supply chains.

- More accurate ways to measure, report and verify climate mitigation goals.

- Efficiency, transparency and reach of carbon markets.

- Behavioral changes by providing incentives and reward systems.

ReFi pillars and current ecosystem

As already mentioned, this ecosystem is structuring around three key verticals:

- Climate: stabilising the climate by reducing and removing GHG emissions.

- Natural Ecosystems: Restoring ecosystems by nurturing biological diversity.

- Social justice: Regenerating local economies while enhancing inclusivity and diversity.

One of the most promising mission-driven blockchains in this space is Celo. Rooted in regenerative economics inspired by the work of Charles Eisenstein, Celo’s mission is to enable a financial system that creates the conditions for prosperity for everyone.

Arguably, 2022 biggest milestone for crypto and impact was the Ethereum merge. Last September, the blockchain made its switch from Proof-of-Work to Proof-of-Stake lowering Ethereum’s running emissions by 99.95%. More recently, a coalition from the Ethereum Community, ReFi and Public Goods movements, launched the Ethereum Climate Platform to offset its entire legacy carbon footprint.

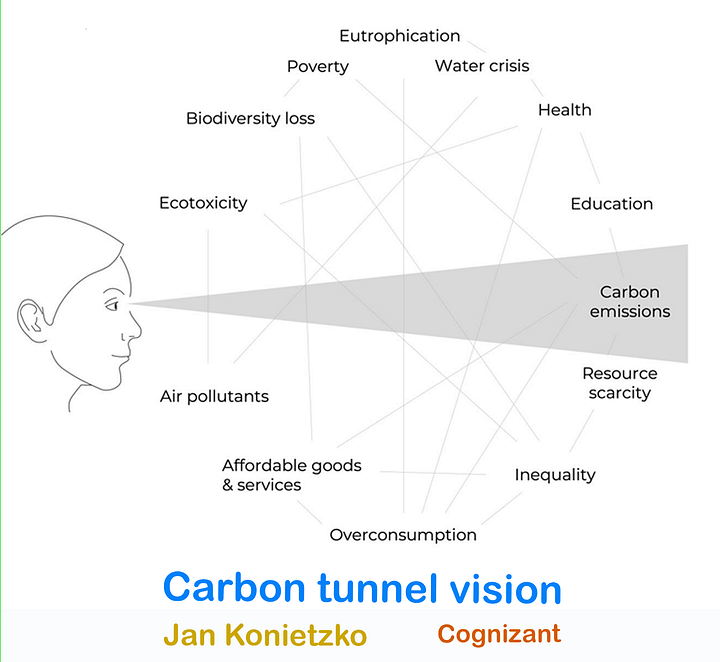

In its early stages, the ReFi movement has focused on the voluntary carbon market so that it can scale with accountability and transparency. The tokenisation of carbon credits use case as a collateral asset represents a milestone in the space. However, mindful of the interconnectedness of global issues, ReFi is overcoming the “carbon tunnel vision” and embracing broader social, economic, and ecological values through projects targeting plastic removal, community economies, forest biodiversity, marine ecosystems, Universal Basic Income (UBI) etc.

Crucially, this ecosystem is promoting wider diversity than in the traditional crypto space, recognising the importance of multidisciplinarity and of embracing a richer set of profiles in terms of gender, age and ethnicities. We cannot replicate existing power structures of white-male Global-North finance/tech profiles. Instead, ReFi is intentional about opening it up to the Global South and a wider spectrum of perspectives. That’s the only way for ReFi to be truly transformative, deliver on its promise … and stay the course!

Opportunities

According to Jori Armbruster, EthicHub co-founder, the biggest opportunity for crypto lies in solving the problems of traditional financial systems (TradFi). DeFi will become mainstream provided it leverages on this technology to solve real-world problems where TradFi has failed, namely the 2 billion people worldwide who are still unbanked or underbanked.

In the same vein, Tomer Bariach, Flori Ventures founder, estimates that real-world credit solutions represent a trillion-dollar opportunity and will bring the next billion people to crypto. DeFi opened the door for new credit and liquidity models and can now arbitrage the huge interest rate gaps between global regions to level the playing field.

In this regard, EthicHub is a multi-award pioneering ReFi use case. Since 2017, the start-up has provided microloans to unbanked smallholding farmers in LatinAmerica. They are backed by real world assets, coffee and cocoa, and crowd-collateral from the farmer, auditor and the community, both in fiat loans and the native token Ethix. EthicHub provides risk-managed lending with a compensation pool that automatically pays lenders their yield if a borrower does not pay in time. It created a virtuous circle that aligns incentives of all stakeholders, provides economic, social and biodiversity benefits for the local communities while keeping the default rate at a record < 1%.

As part of the new wave of ReFi, EthicHub supports real-world assets (RWA) and ecosystem services that it makes collateralizable. According to research, the tokenisation of RWAs will be one of the major growth areas in 2023. ReFi is recreating traditional financial instruments backed by nature including tranched baskets, forwards and futures markets, loan and stablecoin collateralisation. Blended finance and impact investing can be powered by the transparency, efficiency and immutability of smart contracts leveraging crypto economics and DAO governance. Web3 tools can help towards bridging the current gap of over $800 BN between needed nature-related investment and current financing.

Conclusions

2023 has been hailed by many as the year ReFi will go mainstream. As an ecosystem, we are at a crucial juncture to deliver on the enormous potential of ReFi to create real world impact by providing financial incentives for projects that restore “resources essential for planetary wellbeing” while enhancing social justice.

Web3 holds the promise of an economic and governance infrastructure that is more resilient, equitable and collaborative. A multitude of projects are already paving the way for crypto and impact becoming a reality and no longer an oxymoron! In the midst of rising mistrust around crypto, the ecosystem needs to work collaboratively to articulate and reinforce the regenerative narrative of crypto and ReFi. The focus must imperatively be placed on creating and multiplying tangible and measurable impact while moving away from traditional crypto bombastic storytelling and toxic hype.

TL;DR: the guiding star of ReFi is transparency and real impact on the ground. Let’s make it happen together! 💫💫💫

Sources:

- https://www-coindesk-com.cdn.ampproject.org/c/s/www.coindesk.com/consensus-magazine/2022/12/20/refi-goes-mainstream-crypto-2023/?outputType=amp

- https://senken.medium.com/9-climate-markets-predictions-for-2023-e8cdd688d175

- https://www.forbes.com/sites/bernardmarr/2022/10/18/the-top-five-web3-trends-in-2023/?sh=6a31f438b3f2

- https://www.weforum.org/agenda/2022/09/regenerative-finance-web3-climate-change/

- https://www.linkedin.com/pulse/blockchain-unleashed-climate-action-bjorn-soren-gigler-phd-/?trackingId=

- https://je.mirror.xyz/S-dpms92hw6aiacUHoL3f_iAnLVDvbEUOXw7wpy7JaU

- https://www.youtube.com/watch?v=or-lXoWEJHg

- https://mirror.xyz/joriab.eth/mEFhd_0BHNf61eEQYNTkMiL-GON21NjLQChK0DJxPjk

- https://medium.com/floriventures/real-world-credit-solutions-will-be-a-trillion-dollar-opportunity-ee4d5256394f

- https://je.mirror.xyz/S-dpms92hw6aiacUHoL3f_iAnLVDvbEUOXw7wpy7JaU

- https://blog.refidao.com/refi-roundup-2022/

- https://medium.com/coinmonks/the-refi-climate-stack-a778ce82bf71

- https://www.coindesk.com/consensus-magazine/2023/02/06/the-rise-of-cryptos-brand-of-regenerative-finance/

- https://www.notion.so/refi-dao/ReFi-Links-to-Resources-824659d1b2fd430fa1d02f258d125f2c